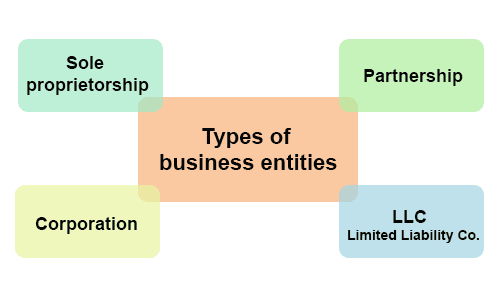

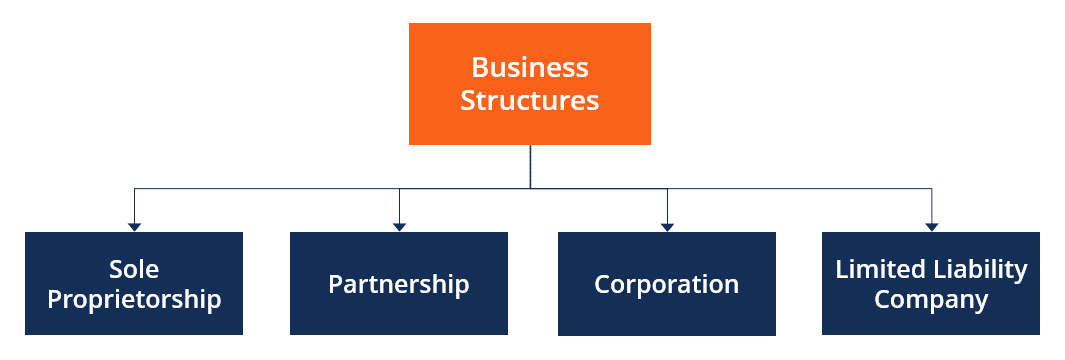

Choosing Your Business Entity

Entity Structure Impacts Liability, Taxes.

LLC

LLCs provide pass-through taxation for simplified reporting.

Pros

Cons

Things to Know

S-Corp

S-Corp status can add administrative complexities.

Pros

Cons

Things to Know

C-Corp

C-Corps offer unlimited growth potential & separate legal status.

Pros

Cons

1. Double Taxation Risk

Things to Know

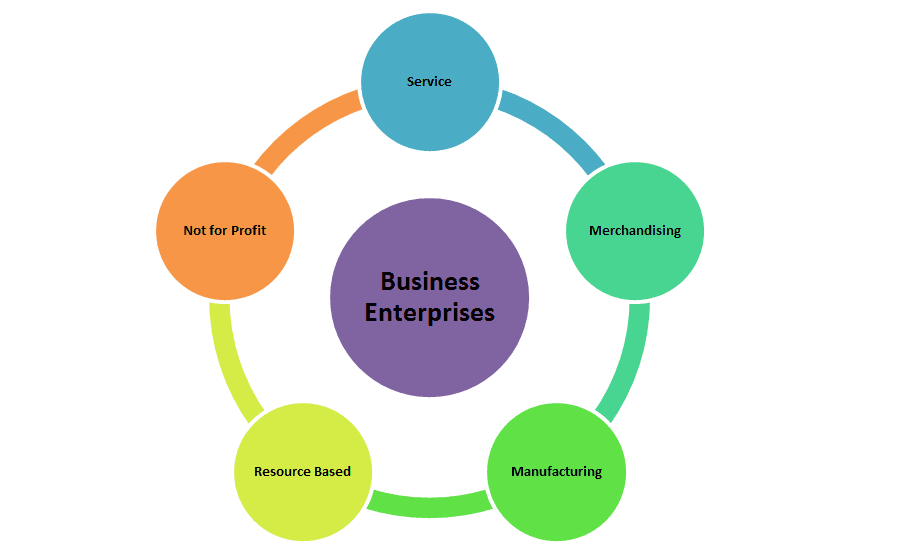

Non-Profit

Non-profits enjoy tax-exempt status and fulfill social missions.

Pros

Cons

Things to Know

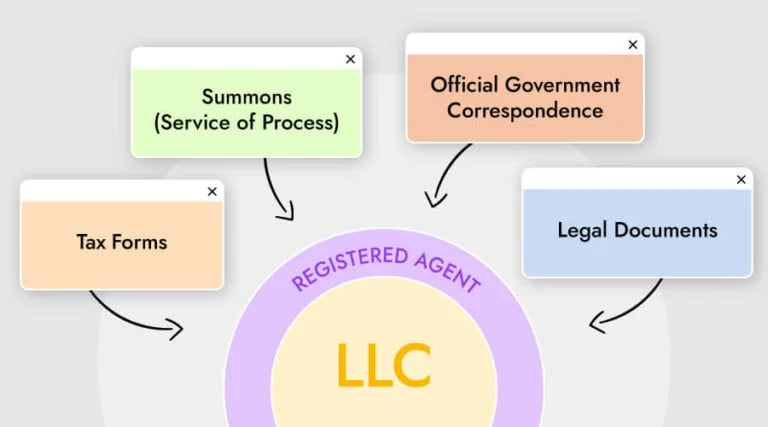

What You Need to Be Official

The Four Essentials

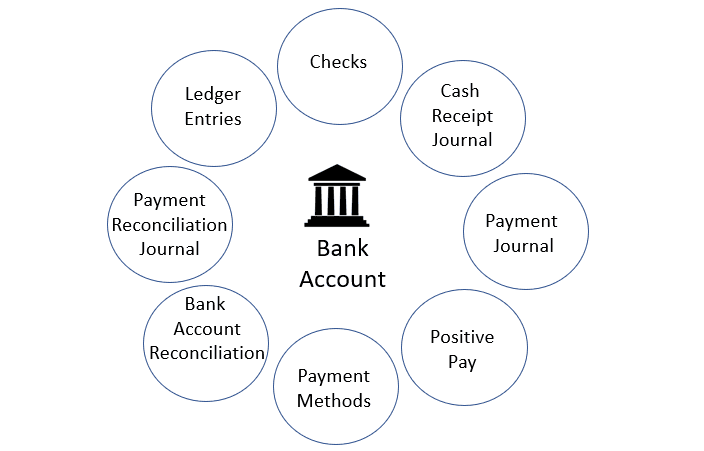

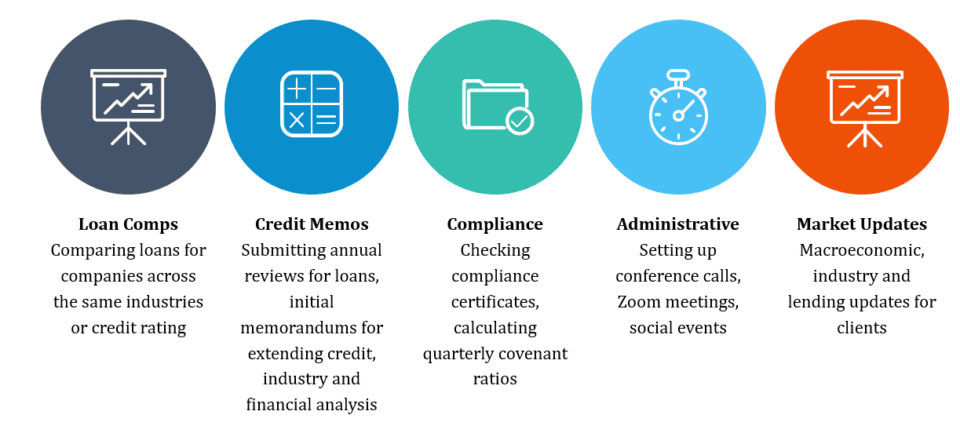

Business Banking

Open a business bank account to manage finances separately and professionally.

How it Works Through First Stop Business

Talk to a Professional

- Choose a Name: Ensure the name is unique and meets your state’s LLC naming requirements.

- File Articles of Organization: Submit the Articles of Organization (or Certificate of Formation) to your state’s business filing office (usually the Secretary of State). This document includes essential information about your LLC, such as its name, address, and the names of its members.

- Pay the Filing Fee:Pay the required state filing fee, which varies by state.

Documents

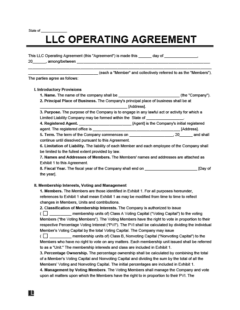

Create Operating Agreement

- Draft an LLC Operating Agreement, which outlines the ownership and operating procedures of the LLC. While not always legally required, it’s an essential document for managing the LLC and resolving disputes among members.

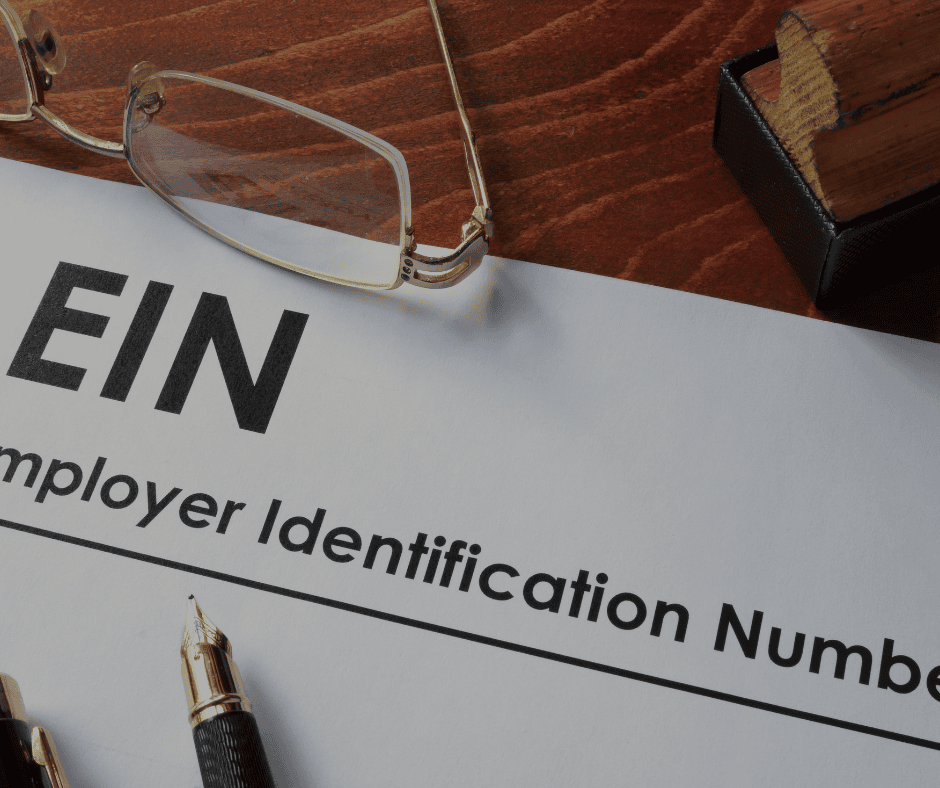

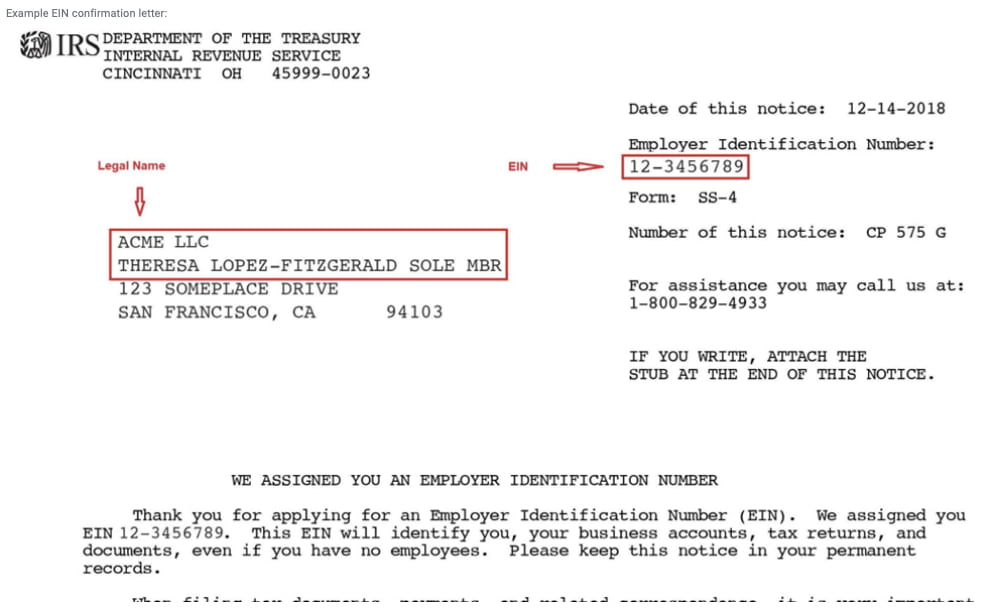

Tax Identification

Submitting Your Documents

- Apply for an EIN and you can get your EIN immediately upon completing the application.

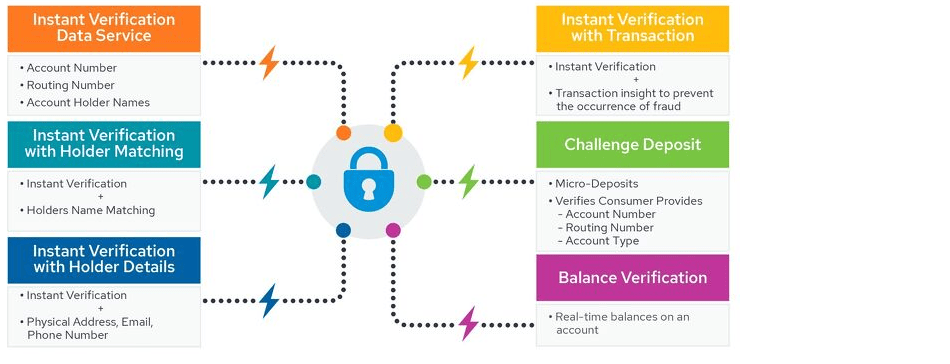

Open Business Banking

Verifying Business Info

Elevate Your Growth, Invest in Your Business, Invest in Yourself

From Side Hustle to Thriving Business

From Side Hustle to Thriving Business

Transform your passion into profit with our expert guidance. Build your business strategically, achieving extraordinary success and turning dreams into reality.

Invest in Yourself Through Your Business

Invest in Yourself Through Your Business

Investing in your business is investing in yourself, enhancing skills, driving personal growth, and empowering you through each challenge and success.

Empower Yourself by Building Your Business

Empower Yourself by Building Your Business

Building your business is a journey of self-investment. Challenges and successes sharpen your skills, unlocking your full potential.

FAQs: Key Steps for Starting Your Business

Essential Business Entity and Registration Answers.