Growth, Challenges, and Opportunities in a Post-Pandemic Economy

This report, the third in Brookings Metro’s series on Black-owned businesses, analyzes data from the Census Bureau’s Annual Business Survey (ABS) to assess the state of these businesses across U.S. metropolitan areas. It supports the Path to 15|55 initiative, which aims to convert 15% of Black-owned sole proprietorships into employer firms, potentially adding $55 billion to the U.S. economy. Using data collected in 2020, the report provides insights into the early pandemic period and specifically highlights Black women-owned businesses. Key findings include:

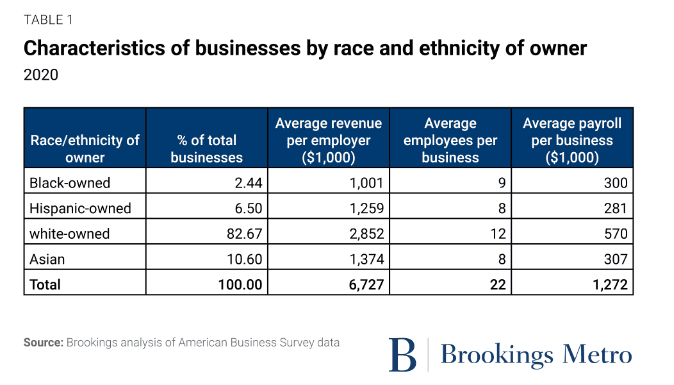

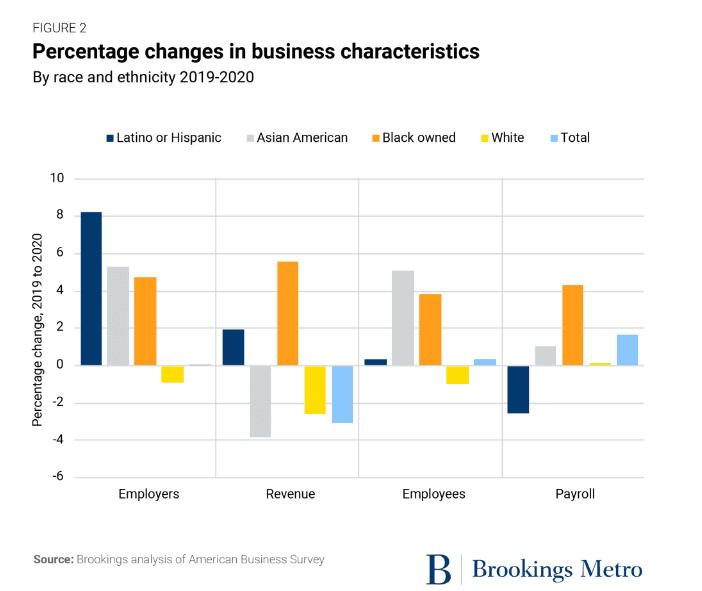

Demographics and Growth: In 2020, Black individuals made up 14.2% of the U.S. population but only 2.4% of employer-firm owners. Comparatively, Latino or Hispanic people were 18.7% of the population and 6.5% of employer-firm owners, while Asian Americans were 6% of the population and 10.6% of employer-firm owners. Black-owned businesses grew by 4.72% (6,351 firms) from 2019 to 2020, trailing Latino or Hispanic (8.19%) and Asian American (5.33%) businesses but surpassing white-owned businesses, which decreased by 0.9%.

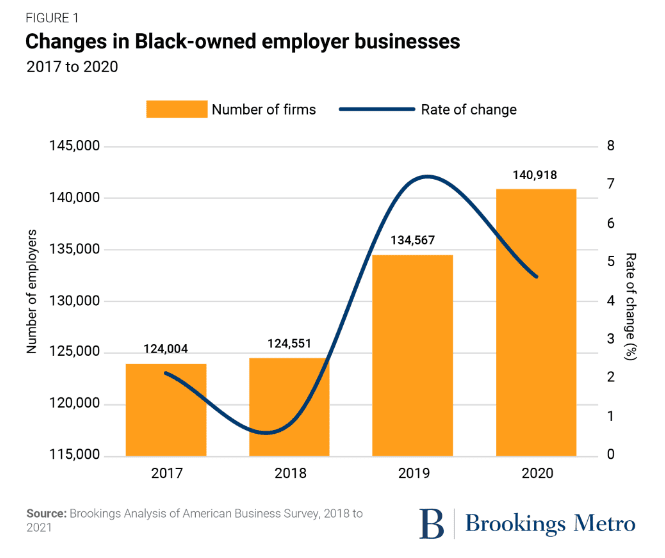

Pre-Pandemic Trends: From 2017 to 2020, the number of Black-owned businesses increased by 13.64%, significantly outpacing the overall business growth rate of 0.53%. In 2020, Black-owned firms generated an estimated $141.1 billion in gross revenue, an 11% rise since 2017.

Economic Impact: Black-owned businesses saw notable increases in revenue, employees, and payroll. In 2020, these businesses employed 1.321 million people and created 48,549 new jobs, contributing an additional $1.7 billion in payroll to the U.S. economy.

Future Projections: At the current growth rate of 4.72%, it would take 256 years for Black business ownership to match the Black population's share in America. Achieving parity in 15 years requires a 74.4% growth rate; in 25 years, a 44.6% growth rate; and in 50 years, a 22.3% growth rate.

Geographical Distribution: The top 10 metro areas for Black-owned businesses are all in the Southeast, with three in North Carolina. However, no metro area has a proportion of Black employer firms equal to or exceeding its Black population share.

Black Women-Owned Businesses: Despite the challenges of COVID-19, from 2017 to 2020, the number of Black women-owned employer businesses increased to 52,374, making up 37.2% of all Black-owned businesses, a rise of 1.41 percentage points. In 2020, Black women constituted about 7% of the U.S. population and 13.9% of American women but owned only 0.91% of all businesses and 4.23% of women-owned businesses.

Educational Attainment: A significant proportion (37.9%) of Black women business owners have advanced degrees, including 19.1% with master's degrees, surpassing the national average of 23.5%.

Growth Rate: Black women-owned employer businesses grew by 18.14% between 2017 and 2020, outpacing the growth rates of women-owned businesses (9.06%) and Black-owned businesses (13.64%). This growth parallels the rise of small sole-proprietor businesses owned by Black and Latino or Hispanic women. However, the extent to which this growth is due to structural changes in business and lending sectors fostering inclusive growth is uncertain. A deeper analysis of these trends could inform strategies to further support and expand these businesses.

The Impact of the COVID-19 Pandemic and Social Unrest on Black-Owned Businesses

The Impact of the COVID-19 Pandemic and Social Unrest on Black-Owned Businesses

The COVID-19 pandemic, coupled with the protests following the murder of George Floyd, brought significant attention to issues of Black wealth, health, and overall well-being. These crises highlighted the systemic issues contributing to the disproportionate number of stops, arrests, and convictions among Black Americans, as well as the chronic underinvestment in Black businesses. During the widespread shutdowns, Black businesses were particularly hard-hit, often unable to secure federal COVID-19 relief loans.

Following George Floyd’s death, the 50 largest public companies in America collectively pledged $49.5 billion to combat racial inequality. However, a Washington Post analysis revealed that 90% of these commitments were in the form of loans or investments from which corporations could profit. Despite this, a portion of the funds was directed towards supporting and developing Black-owned businesses. Additionally, broader federal relief funds appeared to enhance Black business ownership. The National Bureau of Economic Research identified a surge in new businesses in Black neighborhoods from 2019 to 2020, correlating with the first two rounds of pandemic relief checks.

Both federal and state bodies are now investing more in businesses owned by people of color. The Biden administration has issued executive orders to bolster racial equity and support underserved communities, emphasizing economic justice. Initiatives include aiming for 50% or more of federal contracting dollars to be awarded to small, disadvantaged businesses by 2025, and establishing racial equity committees to address disparities in financial inclusion and access to capital, among other areas.

Investments in Black businesses during the pandemic, whether intentional or passive, might pave the way for future development efforts. However, there is also a risk that these efforts could prove to be a one-time anomaly. There are encouraging signs that some racial gaps are closing. For instance, the disparity in unemployment rates between Black and white Americans has decreased since 2010, and the aggregate unemployment rate for Black Americans has returned to its pre-pandemic level of 5%, down from 9.9% in April 2021. Nevertheless, Black unemployment remains higher than the national rate of 3.5% as of March 2023.

Despite some progress, the pace of addressing racial wealth and prosperity disparities remains slow. While racial wealth gaps have slightly narrowed since 2013, income inequality has worsened, with the gap between the wealthiest and poorest households growing. For example, the wealth of the highest-income white households has increased 75 times more than that of lower-income families and 195 times more than the median low-income Black family. These wealth inequalities impact the rates of racial and ethnic representation in business ownership, potentially undermining the progress made by Black-owned businesses.

This report examines the state of Black-owned businesses from 2017 to 2020, with a particular focus on those owned by Black women. Black women are one of the most underserved groups in the nation, with the lowest proportional democratic representation and the largest median income gap for full-time workers. Despite these challenges, the rise in Black-owned businesses during this period was significantly driven by increases in Black women founders. This report analyzes the growth in business ownership among Black women and its implications for equity in business ownership in America.

In 2020, Black Americans comprised 14.2% of the U.S. population but only 2.4% of employer-firm owners. In comparison, Latino or Hispanic Americans made up 18.7% of the population and 6.5% of employer-firm owners, Asian Americans were 6% of the population and 10.6% of employer-firm owners, and white Americans constituted 61.6% of the population and 82.67% of employer-firm owners.

The underrepresentation of Black and brown business owners poses a significant barrier to creating a racially inclusive economy in the U.S. Black-owned businesses are crucial not only for restoring value to Black communities but also for strengthening national and local economies. The scarcity of Black-owned employer businesses limits economic growth and hinders opportunities for investment and inclusive development, especially in diverse cities and regions.

From 2010 to 2020, the minority population (those not identifying as white alone) grew from 36.3% to 42.4%, with the number of Americans identifying as two or more races more than tripling. However, the growth rate of minority-owned businesses has been much slower, resulting in a widening gap between population share and business representation. This gap impacts the U.S. economy and limits the benefits for all people. Despite this, there are signs of progress.

Between 2017 and 2020, the number of Black-owned businesses increased by 13.64%, significantly higher than the overall business growth rate of 0.53%. The average annual growth rate for Black-owned businesses during this period was 4.2%, more than 20 times the overall rate of 0.18%. The highest growth occurred between 2018 and 2019, with an 8% increase, but it slowed to 4.7% from 2019 to 2020, likely due to the pandemic's early effects on foreclosure rates and investment decisions. Nevertheless, Black-owned firms generated an estimated $141.1 billion in gross revenue in 2020, an 11% increase since 2017.

If Black business ownership continues to grow at 4.2% annually, it will take 256 years to reach parity with the Black population percentage in America, perpetuating racial wealth gaps. Achieving parity in 15 years requires a 74.4% growth rate; in 25 years, a 44.6% growth rate; and in 50 years, a 22.3% growth rate.

Black-owned businesses were resilient to the pandemic’s impact on revenue and closure rates. Figure 2 shows that from 2019 to 2020, the number of Black owned businesses is estimated to have grown by 6,351, or 4.7%—well above white-owned employer firms (which shrunk by 0.9%), but behind Latino or Hispanic-owned employer firms (which grew by 8.2%) and Asian American-owned employer firms (5.3%). Over the same period, Black-owned businesses increased their proportional share of employees and revenue by a greater extent: Between 2019 and 2020, Black business owners employed more than 1.32 million people, adding 48,549 new jobs and an additional $1.7 billion in aggregate payroll to the U.S. economy.

For more detailed insights, please refer to the article "Who is Driving Black Business Growth? Insights from the Latest Data on Black-Owned Businesses" by Andre Perry, Manann Donoghoe, and Hannah Stephens at Brookings Metro: Brookings Article.